General Outlook

The past week was marked by moderate strength in the US dollar, supported by strong economic data, including a rebound in consumer spending and a decline in jobless claims. The euro came under pressure as the dollar extended its gains, while gold experienced a slight pull-back but remained within its broader bullish structure. Bitcoin hovered just below the $120,000 mark after a brief spike, consolidating its position within an ascending channel. In the week ahead, market attention will remain focused on further macro data from the US, central bank commentary, and regulatory developments in the crypto sector.

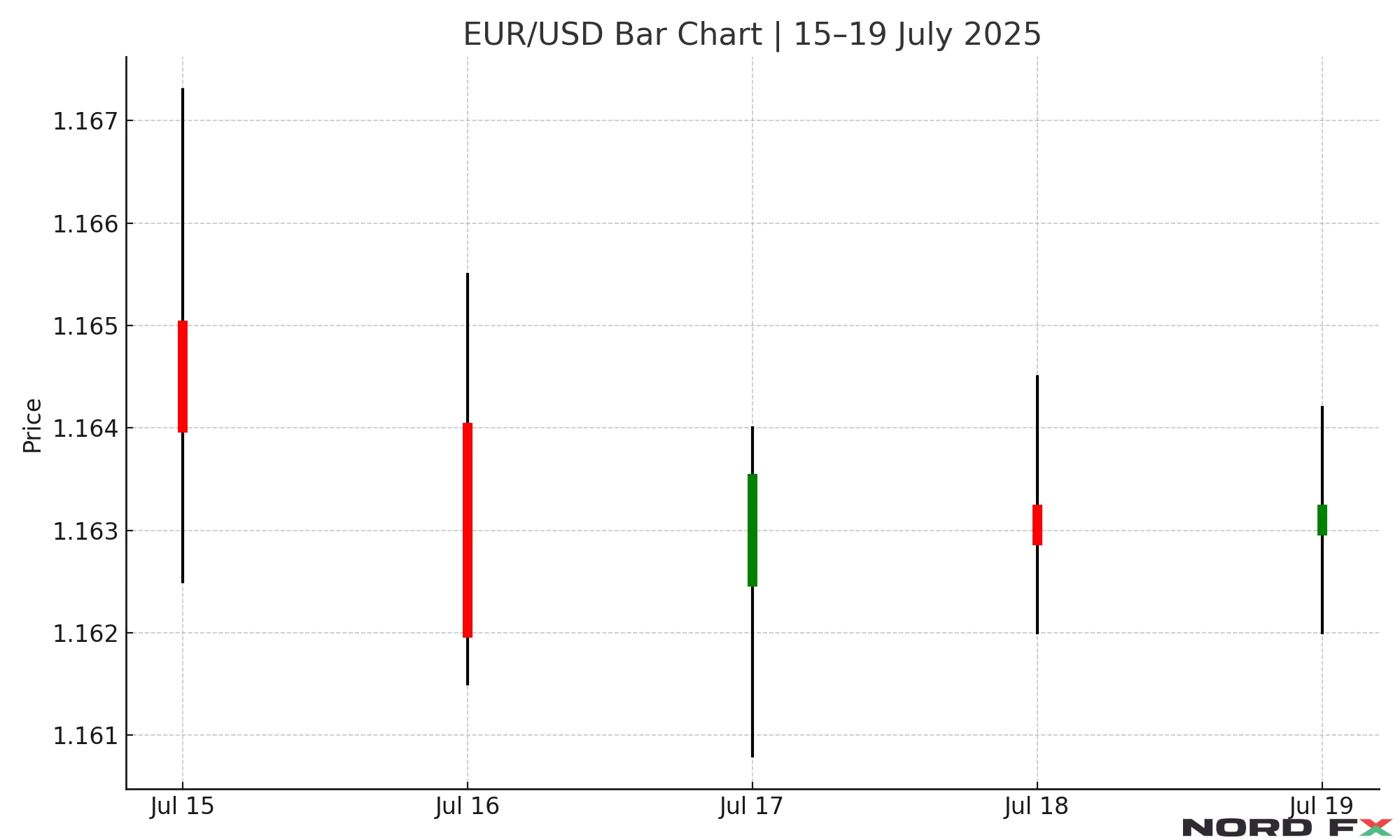

EUR/USD

The euro closed the week near 1.1630, giving up ground as dollar strength persisted. Despite this decline, the overall trend remains tentatively bullish, with moving averages still pointing upward. In the coming days, the pair could attempt to retest resistance near the 1.1750–1.1800 zone. If this level holds as resistance, the euro may retreat towards support at 1.1500 or even lower. However, a successful breakout above 1.1800 would open the way for further gains towards 1.1830 and beyond. On the downside, a confirmed drop below 1.1500 would signal a bearish reversal and potentially target the 1.1400 area. The technical outlook suggests the euro may start the week with an upward correction, but the broader trend remains vulnerable unless bulls regain momentum above key resistance levels.

XAU/USD

Gold finished the week near the $3,340 mark, retreating slightly from earlier highs. However, the market remains within a well‑defined uptrend and continues to form a consolidation triangle. Initial support is now located around $3,325, and a retest of this area could provide a base for another leg higher. If the bullish momentum resumes, the metal could climb back above $3,365 and potentially reach the $3,400–3,450 range. Alternatively, a breakdown below $3,300 would increase downside pressure and expose support in the $3,250–3,275 region. A deeper move below $3,200 would call into question the current bullish scenario. Overall, the price action suggests a period of consolidation, with a potential breakout likely in the coming sessions.

BTC/USD

Bitcoin ended the week just above the $118,000 mark, having briefly tested levels above $120,000 earlier in the week. The broader bullish structure remains intact, with the market supported by recent regulatory clarity and institutional interest. A short-term correction may lead to a retest of the $115,000–116,000 area, which has been acting as a strong support zone. If this area holds, the price could rebound and move back toward $125,000, with a chance to extend towards $130,000. However, a drop below $115,000 would shift momentum, opening the door to a deeper retracement towards $105,000. At the same time, a confirmed breakout above $125,000 would signal renewed strength and bring $130,000–135,000 targets into view.

Conclusion

The coming week presents a critical juncture for all three instruments. The euro may stage a technical bounce but remains under pressure unless it reclaims ground above 1.1800. Gold appears to be consolidating ahead of a breakout, with $3,325 as a key pivot level. Bitcoin continues to show strength, though a brief correction could precede its next leg higher. Traders should remain attentive to macroeconomic data and risk sentiment, which are likely to shape direction across Forex, precious metals, and cryptocurrencies in the days ahead.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.