General Outlook

The August Non-Farm Payrolls report showed the US economy adding only 22,000 jobs, with unemployment rising to 4.3%. Rate-cut expectations remain firmly in place, with markets pricing a high chance of a 25 bp cut at the 17 September FOMC meeting. The US Dollar Index (DXY) closed Friday near 97.74, close to a four-month low. The upcoming week is dominated by Thursday’s twin events – US CPI (11 Sept, 08:30 ET) and the ECB policy decision (11 Sept, 14:15/14:45 CEST) – followed by University of Michigan sentiment (12 Sept, 10:00 ET).

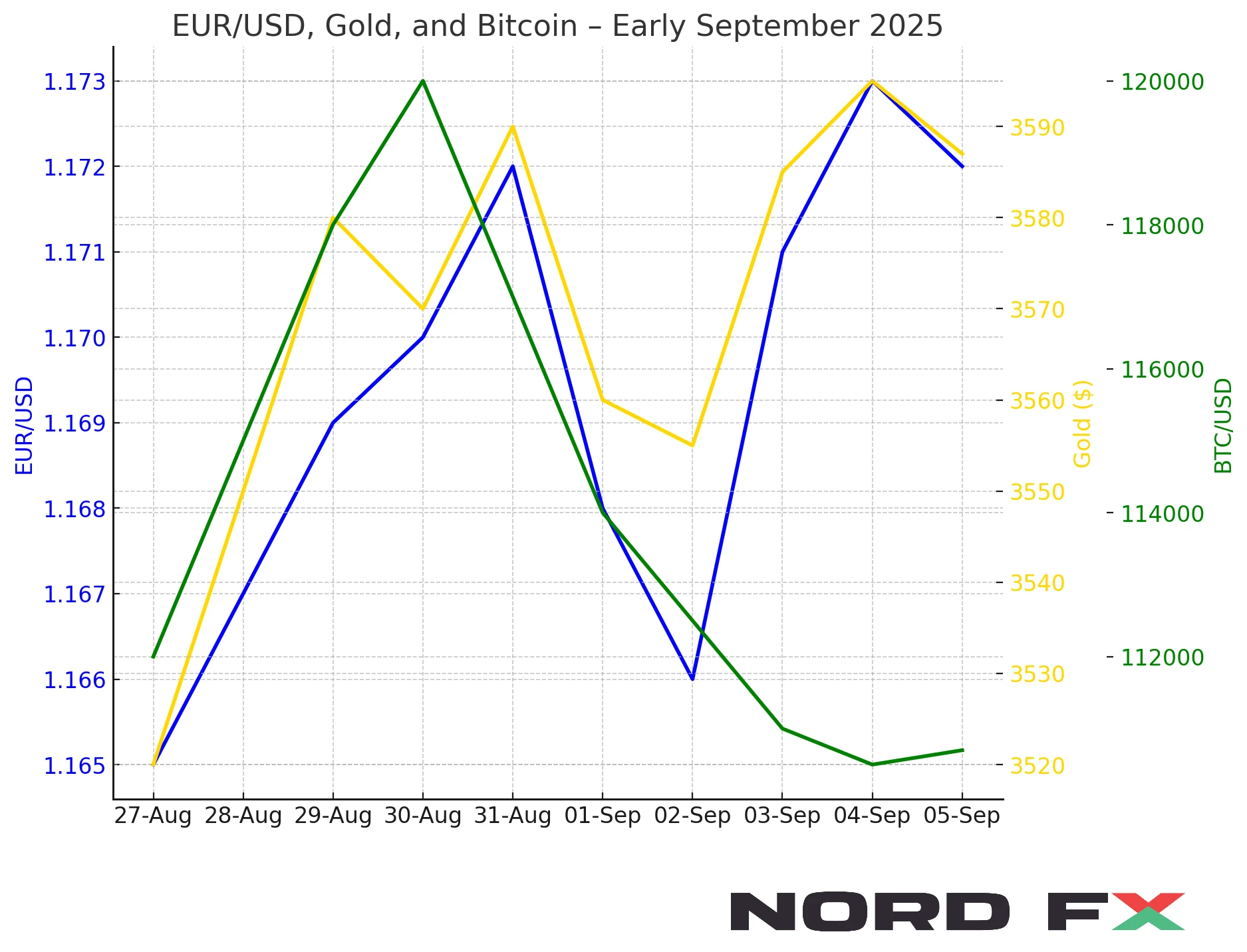

EUR/USD

The pair closed Friday around 1.1723 (ECB ref: 1.1697). Immediate resistance stands at 1.1720–1.1760; a break would open 1.1800–1.1850. On the downside, support comes in at 1.1640–1.1600, then 1.1550. The short-term bias stays cautiously constructive while markets lean toward Fed easing. However, a hot US CPI print could lift the dollar and stall EUR gains, while a dovish ECB could also limit upside.

XAU/USD (Gold)

Gold settled Friday at $3,586.81/oz, after touching a record near $3,600 intraday. Resistance is layered at $3,600–3,650, then $3,700. Initial support is $3,540–3,500, with stronger backing near $3,450. Softer inflation or weak sentiment would encourage dip-buying, while an upside CPI surprise could trigger profit-taking and a pullback toward supports.

BTC/USD

Bitcoin trades this weekend around $110,700–111,000, consolidating below its mid-August record above $123,000. Immediate resistance is $112,500–115,000, then $118,000–120,000. Closest support sits at $108,000–105,000; a break lower could test $103,000, while a close above $115,000 would restore bullish momentum. Macro drivers remain aligned with risk appetite: a benign CPI outcome would likely underpin crypto strength.

Conclusion

During 08–12 September, EUR/USD retains a slight upside tilt as Fed rate-cut expectations stay firm, gold remains well supported near record territory, and bitcoin consolidates just below its August peak. Thursday’s CPI and ECB decision are the week’s defining catalysts; a stronger US inflation print could rapidly reset expectations, lifting the dollar and triggering corrections across bullion and crypto.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back