Short answer

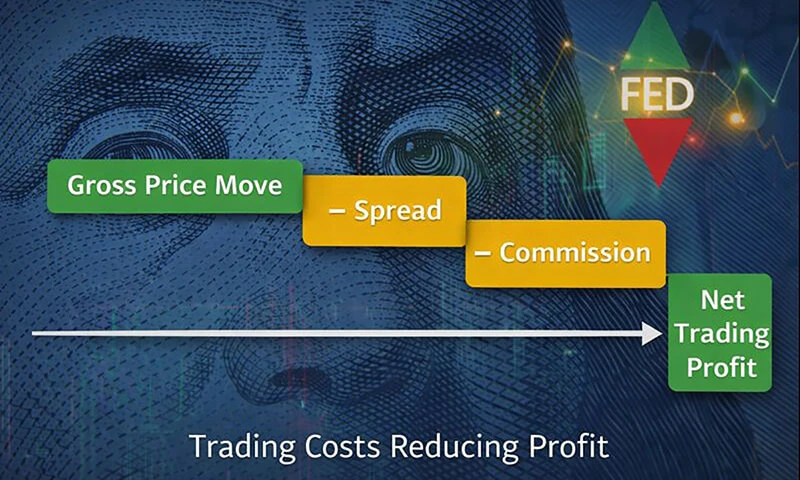

Trading profits are reduced by trading costs such as spread, commissions, swaps, and sometimes partial position closures. Even when price moves in your favor, these costs affect the final result.

The hidden costs in every trade

Many traders focus only on price movement, but real trading includes costs.

The main ones are:

- spread

- commission (on some account types)

- swap (overnight fee)

These are normal market expenses.

How spread affects your profit

When you open a trade:

- Buy opens at Ask

- Sell opens at Bid

The spread is immediately applied.

This means:

- price must move by at least the spread before profit begins

- part of the movement goes to covering the spread cost

Large spreads reduce net profit more noticeably.

How commissions reduce net profit

Some accounts charge a fixed commission per trade.

This commission:

- is deducted when opening or closing positions

- reduces your final profit

- is separate from spread

Even a profitable trade will show slightly lower net result after commission.

What is swap and when it applies

Swap is an overnight financing fee.

It applies when:

- a trade is held past the trading day rollover

- depending on instrument and direction

Swap can be:

- negative (cost)

- sometimes positive (credit)

Most short-term trades avoid swap, but long-term trades feel it more.

Why partial closures affect profit

In some cases:

- part of a position may close automatically (risk control or stop out)

- remaining position continues running

This reduces overall position size and final profit potential.

The illustration shows how costs are subtracted from price movement to form real trading profit.

Why this is normal market behavior

These costs are not errors.

They represent:

✅ liquidity access

✅ execution service

✅ market financing

All professional markets operate with transaction costs.

Why this matters for traders

Understanding trading costs helps traders:

- calculate realistic profit targets

- choose appropriate account types

- avoid disappointment

- manage risk accurately

Most “missing profit” issues come from ignoring costs.

What’s next

Now that costs are clear, the next topic is:

Why did my margin level drop without opening new trades?

This connects floating loss with margin mechanics.

Revenir en arrière Revenir en arrière