Short answer

Margin calls are based on equity, not balance. Even if your balance is positive, floating losses can reduce equity to critical levels and trigger a margin call.

What balance really means

Balance is:

- closed trade result

- money after profits and losses are finalized

- does not change while trades are open

It reflects your account history — not current risk.

What equity actually represents

Equity is:

Balance + floating profit/loss

It changes constantly with market movement.

When trades go against you:

- floating loss increases

- equity decreases

This is what the system monitors for risk.

Why margin calls are triggered by equity

Margin call happens when:

- equity drops too close to required margin

- risk becomes too high

Even with positive balance:

👉 falling equity can still trigger margin call

Simple example

You may have:

- Balance: $5,000

- Floating loss: -$4,000

- Equity: $1,000

Your balance looks fine — but your equity is almost gone.

This is when margin call appears.

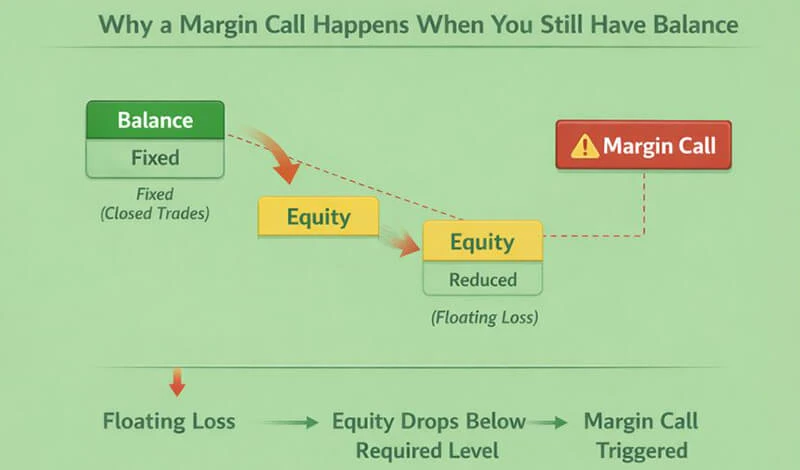

The illustration shows how floating loss reduces equity while balance remains unchanged.

Why this is normal risk control

This is not:

❌ platform error

❌ broker interference

❌ money disappearing

This is:

✅ automatic risk protection

✅ standard trading safety system

✅ used by all leveraged markets

Why this matters for traders

Understanding equity vs balance helps traders:

- avoid surprise margin calls

- manage position size

- use leverage safely

- monitor real risk

Most margin problems come from watching balance instead of equity.

What’s next

Next article:

Why do spreads suddenly increase during news and holidays?

This explains 24/7 markets and volatility behavior.

Go Back Go Back