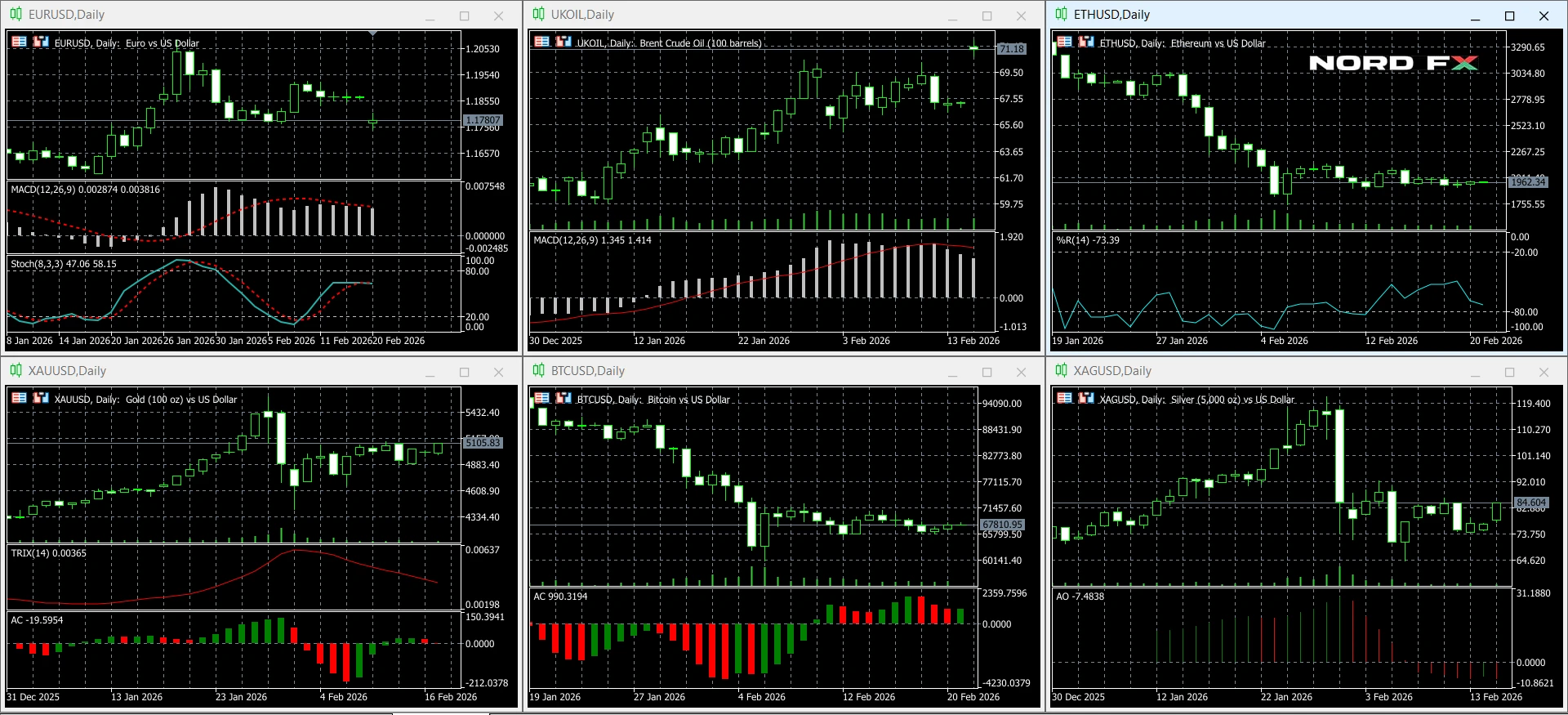

The past trading week ended with elevated volatility across FX, commodities, and cryptocurrencies. Precious metals remained in a high-momentum phase, while crypto assets continued to stabilise after earlier corrections. By the close on Friday, February 20, EUR/USD finished near 1.1765, Brent settled around 71.76 per barrel, gold (XAU/USD) ended the week at 5,080.90, and silver (XAG/USD) closed at 82.343. In the digital asset market, Bitcoin (BTC/USD) is trading near 67,937 and Ethereum (ETH/USD) near 1,963 as of Saturday, February 21. The final week of February may remain technically driven, with markets reacting sharply to breaks of nearby support and resistance levels.

EUR/USD

The pair remains inside a consolidation phase after a choppy week. Price action is holding near mid-range levels, and momentum remains moderate, suggesting that the next directional move will depend on a breakout from the current corridor.

During the coming week, EUR/USD may test support in the 1.1745-1.1710 area. If this zone holds, a rebound toward 1.1840-1.1900 is possible. A break and consolidation above 1.1900 would open the way toward 1.1960-1.2030.

A confident breakout below 1.1710 would cancel the bullish scenario and indicate a decline toward 1.1680-1.1600.

Baseline view: cautiously bullish while the pair holds above 1.1745.

Brent Crude Oil

Brent ended the week near 71.76 and remains vulnerable to swings around resistance. The recent rebound looks constructive, but the broader structure still requires confirmation through a sustained break above key levels.

The market may attempt a move toward 72.80-74.20. From there, renewed selling pressure could return prices toward 70.80-69.50.

A breakout above 75.00 would invalidate the corrective-bearish scenario and suggest recovery toward 76.50-78.00.

Baseline view: neutral-to-bullish while Brent holds above 70.80.

Gold (XAU/USD)

Gold closed at 5,080.90 and remains within a bullish structure after a strong upward impulse. However, short-term corrections remain possible as the market digests recent gains.

During the week, gold may correct toward 5,020-4,980. If support holds in this area, renewed growth toward 5,150-5,205 becomes likely. A consolidation above 5,205 would open the way toward 5,280-5,350.

A confident breakout below 4,980-4,950 would cancel the bullish scenario and signal a deeper correction toward 4,930-4,860.

Baseline view: bullish while gold holds above 4,980.

Silver (XAG/USD)

Silver closed at 82.343 and remains highly volatile, broadly following gold’s momentum. The technical structure stays constructive, but pullbacks may be sharp.

The price may correct toward 80.00-78.50. If buyers defend this zone, a rebound toward 84.50-86.30 is possible. A breakout above 86.30 would open the way toward 88.00-90.00.

A confident breakout below 78.50 would indicate a decline toward 76.60-74.50.

Baseline view: cautiously bullish while silver remains above 78.50.

Bitcoin (BTC/USD)

Bitcoin continues to trade in a stabilisation mode near the mid-60,000 area, with sellers still defending rebounds. The broader structure remains fragile, and a clear breakout is required to confirm direction.

In the week ahead, BTC/USD may attempt growth toward 71,000-73,000. A rejection from this area could trigger renewed selling toward 66,000-64,000, with extended risk toward 62,500.

A breakout and consolidation above 75,000-77,000 would cancel the bearish scenario and open the path toward 80,000-83,500.

Baseline view: neutral-to-bearish while BTC/USD remains below 73,000.

Ethereum (ETH/USD)

Ethereum is holding just below the 2,000 level and attempting to build a base after the recent correction. Resistance remains close, and the market may continue to oscillate within a broad range.

ETH/USD may retest 2,000-1,950 during the week. If buyers defend this area, a rebound toward 2,080-2,150 is possible. A break above 2,150-2,250 would strengthen the bullish case and open the way toward 2,400-2,550.

A confident breakout below 1,950 would signal continuation of the decline toward 1,850-1,750.

Baseline view: neutral while holding above 1,950.

Summary

Markets enter the last full week of February with metals still showing strong momentum, crypto attempting stabilisation, and oil testing important resistance. EUR/USD remains range-bound, with direction likely to depend on a break from nearby technical levels. Gold and silver retain a bullish bias while key supports hold. Brent requires a sustained breakout to confirm broader recovery, while bitcoin and Ethereum remain sensitive to resistance levels that define their near-term upside potential.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.